China’s tech rivalry with the U.S. is heating up again. On July 31, China’s State Internet Information Office (SIIO) held a surprise interview with NVIDIA executives, asking for a full explanation of the design of the H20 AI chip.

Chinese officials pointed out that the chip may have the risk of “surveillance backdoor” and “remote shutdown”, which is related to national security, and the incident immediately triggered a high level of concern from the industry and the market.

Why did China negotiate with Fidelity?

According to Chinese official media reports, China’s negotiation with Fidelity is an investigation based on the Network Security Law, the Data Security Law and the Personal Information Protection Law.

The focus is on the possibility that H20 chips may have built-in location tracking and remote shutdown mechanisms, a requirement that the U.S. government has included as an export restriction, causing the Chinese government to worry about data leakage and information security risks associated with large-scale deployment.

U.S. tech experts have also pointed out earlier that Pfizer NVIDIA has mature capabilities in related surveillance technologies. For China, if these chips enter the government, financial and cloud applications without being vetted, they may become a potential national security loophole, and therefore strict security vetting has been initiated.

Pfizer Under Double Pressure in China and U.S.

NVIDIA Phaidon was banned from selling H20 chips to China earlier this year due to U.S. export controls, and the loss was estimated to be US$13.5 billion at that time. The loss was estimated to be US$13.5 billion at the time. Subsequently, China and the U.S. reached a partial consensus on rare earth policy, and exports were resumed.

Now that China is negotiating with NVIDIA, H20 products are once again facing the challenge of entering the Chinese market.

At the same time, Pfizer is also facing antitrust investigations and smuggling of high-end chips in the China market. It is rumored that hundreds of thousands of chips, including H100 and B200, have been smuggled into China through unofficial channels, which has further compressed the market demand for H20.

Domestic AI chips take advantage of the rising trend

The outside world believes that China’s tough action against Fidelity this time also reflects the rapid progress of domestic AI chips. The market share of Huawei Rise 910B and Cambrian Siyuan 370 has increased rapidly, from 12% to 28% in the first half of 2025, and they are gradually replacing imported chips in the fields of politics and finance.

The A-share semiconductor sector rose immediately after the announcement of the talks. Cambrian rose more than 7% during the trading session, while SMIC and Huahong Semiconductor rose in tandem, with the market’s expectation of “domestic substitution” clearly heating up.

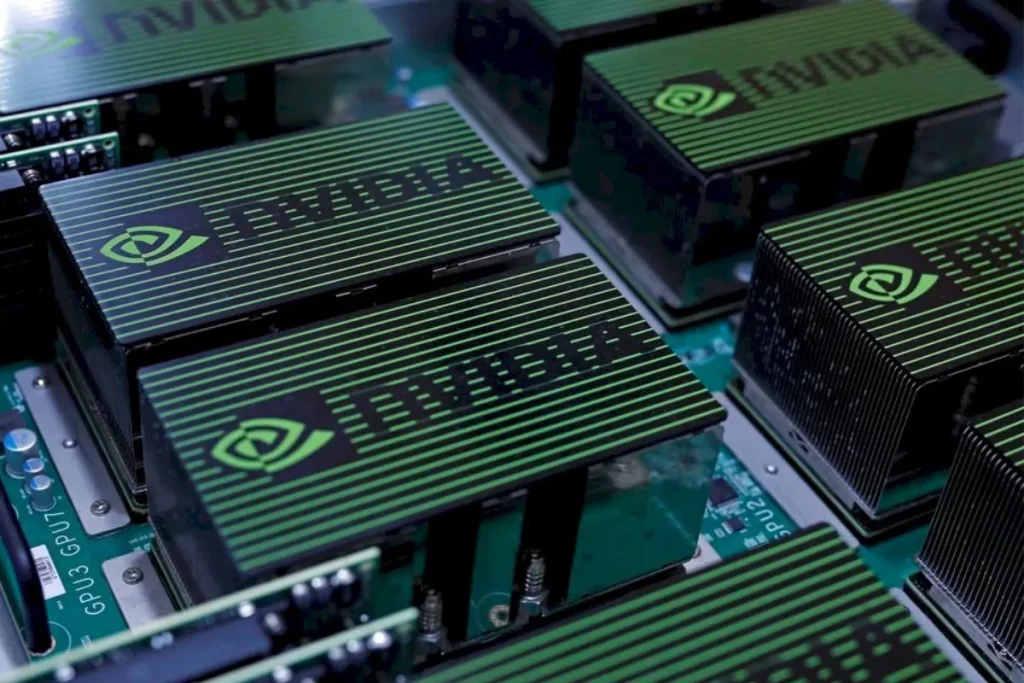

NVIDIA Phaidon H20 Chip What is H20 Chip Nano Introduction

H20 is an AI-accelerated chip designed by NVIDIA Fidelity for the China market by the end of 2023, utilizing the Hopper architecture and TSMC’s 4N process.

To comply with U.S. export restrictions, the chip cuts GPU cores by about 41%, resulting in a performance cut of about 28% compared to H100, but retains 96GB of HBM3 memory and 4.0 TB/s bandwidth, making it suitable for large-scale AI model deployments in power-constrained scenarios.

Despite its memory advantages, the market response to the H20 has been lukewarm. Some Chinese resellers have described the H20 as “a weakling with a lot of memory but not enough performance”, and in September 2024 it was rumored that NVIDIA had stopped accepting orders, suggesting that the product’s lifespan may have been short-lived.

Conclusion: US-China chip tug-of-war enters new phase

From U.S. export restrictions, China’s emphasis on security risks, and the gradual rise of domestic chips, NVIDIA is forced to find a balance between the U.S. and China. China’s negotiation with NVIDIA underscores the fact that all foreign chips entering the Chinese market will face more stringent scrutiny and compliance requirements in the future.

The global semiconductor industry chain is further polarized, and the confrontation between the U.S. and China is expected to be long-term. For investors and industries, this is not only a market competition, but also a strategic game under geopolitics.

Want to stay on top of the latest trends? Follow TechDuker for the latest in AI, cryptocurrency, entertainment, technology, and the world.